The Evolving Face of the US Homebuyer: Affordability Challenges and an Aging Buyer Demographic

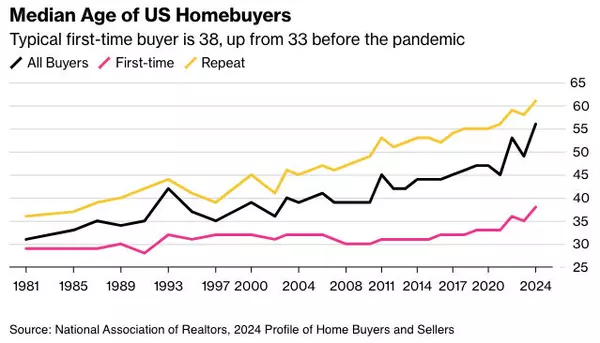

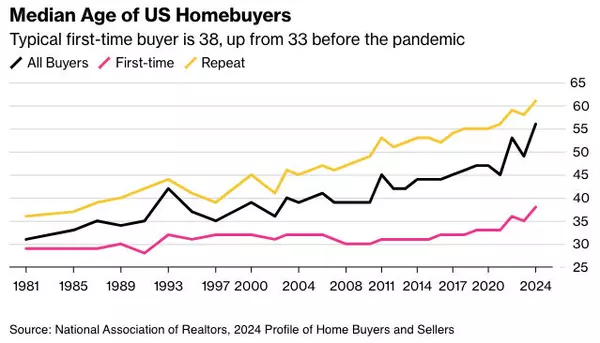

The National Association of Realtors’ (NAR) 2024 report paints a vivid picture of an evolving US housing market, one where affordability constraints and economic pressures are reshaping the profile of today’s typical homebuyer. These trends are altering the landscape of homeownership, with potential long-term impacts on the housing market and the broader economy. Rising Average Age of Homebuyers The age of the average homebuyer has climbed steadily, now reaching a record high of 56 years old. For first-time buyers, the average age has risen to 38, nearly ten years older than it was in the early 1980s. This trend reflects the struggles of younger buyers, who often face financial obstacles that delay their entry into the market. Many younger individuals contend with high student debt, stagnant wage growth, and historically high home prices, all while mortgage interest rates add to their financial burden. The result? Younger prospective homeowners are often pushed to the sidelines, unable to compete with more financially established buyers. Shifting Demographics: Single Women Rising in Homeownership Another demographic shift noted in the NAR report is the rise in single female homeowners, who now make up 20% of recent homebuyers, while single men account for just 8%. This change highlights a shift in homeownership goals among single women and suggests greater financial independence and empowerment in this group. The trend also reflects broader social changes, where single women increasingly view homeownership as a valuable and attainable milestone. A Market Favoring the Financially Secure High prices and limited inventory have created what experts are calling a “bifurcated housing market.” Buyers who succeed in this market are often financially established, many bringing wealth accumulated through years of savings or equity from previous homeownership. These buyers can often make substantial down payments or cash purchases, creating a competitive advantage over first-time buyers who struggle with affordability and financing. As a result, homeownership is increasingly skewed toward older, financially stable individuals, excluding many younger and lower-income households from achieving the same goal. Dwindling Share of First-Time Buyers Perhaps the most telling indicator of these challenges is the decline in first-time buyers, who now make up just 24% of the market—a dramatic drop from the 40% share typical before the Great Recession. With affordability metrics at near-record lows, first-time buyers face a daunting path to homeownership. Rising interest rates and inflated property values exacerbate these challenges, leaving many young people locked out of homeownership and reshaping the market around older buyers without children at home. A Glimmer of Hope? While the NAR report reveals sobering realities, there may be a glimmer of hope on the horizon. Recent mortgage application data suggests that some sidelined buyers might be re-entering the market as interest rates stabilize. If this trend holds, younger and more diverse buyers may gradually return, which could lead to a more varied buyer profile over time. At Havas Edge, we’re closely monitoring these demographic shifts to help brands understand and engage with today’s homebuyers effectively. As market dynamics continue to evolve, we look forward to supporting our clients in crafting strategies that resonate with both today’s and tomorrow’s homebuyers.

A Real Estate Agent Helps Take the Fear Out of the Market

Do negative headlines and talk on social media have you feeling worried about the housing market? Maybe you’ve even seen or heard something lately that scares you and makes you wonder if you should still buyor sell a home right now. Regrettably, when news in the media isn’t easy to understand, it can make people feel scared and unsure. Similarly, negative talk on social media spreads fast and creates fear. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says: “In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.” But it doesn’t have to be that way. Buying a home is a big decision, and it should be one you feel confidentmaking. You should lean on a trusted real estate agent to help you separate fact from fiction and get the answers you need. That agent will use their knowledge of what’s really happening with home prices, housing supply, expert forecasts, and more to give you the best possible advice. The National Association of Realtors (NAR) explains: “. . . agents combat uncertainty and fear with a combination of historical perspective, training and facts.” The right agent will help you figure out what’s going on at the national level and in your local area. They’ll debunk headlines using data you can trust. Plus, they have in-depth knowledge of the industry and can provide context, so you know how current trends compare to the normal ebbs and flows in the housing market, historical data, and more. Then, to make sure you have the full picture, an agent can tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you can use all that information to make the best possible decision. After all, making a move is a potentially life-changing milestone. It should be something you feel ready forand excited about. And that’s where a trusted expert comes in. Bottom Line If you need reliable information about the housing market and expert advice about your own move, get in touch with a real estate agent in your area.

Tips for Buying a Home You’ll Love - Even in Your Senior Years

Buying a home is not always as smooth sailing as you'd like it to be, especially if you're older and the best is what you've come to expect. Moreover, your ideal home might look a bit different to accommodate this new phase of life. Nonetheless, it is still possible to find a home that you'll love - even now. If you want to buy or sell, read on for some tips from Team Stiles. Accessibility could be a priority Accessible homes are cropping up more and more these days, and it's understandable why, as our needs tend to change quite significantly in our senior years. Therefore, you might be in the market for a home that is more tailored to your unique requirements such as having no stairs, wider hallways, doorways, etc. How to finance your home When it comes to securing the home of your dreams, your budget is what will ultimately end up determining what you can afford at the end of the day. Of course, you will probably be presented with a few mortgage options to choose from. But this can be a challenging exercise, especially if you don't want to be bound to pay for a mortgage for over 30 years, for example. So be sure to investigate how it works, as well as all your options before settling on one, taking into account how much down payment you'll be able to make upfront and if you'll have enough retirement funds to keep up with your mortgage repayments. Moreover, lenders will often want to have proof that you have sufficient income as well as a good credit score before they'll consider loaning you the funds to purchase your property. So best be sure to have all your ducks in a row beforehand to ensure you don't get caught up in a lot of red tape along the way. Look into a home warranty You’ll also want to protect your investment once you’ve secured a mortgage. Homeowner’s insurance is the first line of defense, and is usually required by lenders to begin with. But there are some items and situations that aren’t typically covered, such as when a system like the HVAC goes out or a major appliance needs repaired or replaced. When a manufacturer’s warranty is no longer in effect, your sure-fire strategy is to purchase a home warranty. First check into the difference between a home warranty and a manufacturer warranty, then research home warranty providers to see what they include in their policies. The last thing you want is to be in lurch when it comes to paying for systems or products when they break down. Knowing where to search for your ideal property Knowing where to search for your ideal property will be the next step in determining if you are able to find the right property match for you. For example, Property Guys Welcome Mat notes that finding the right location might be a deal-breaker for you while still being able to fit within the budget. Therefore, it might be helpful to do some research into what the going rate is for properties to get a fair estimate of what you're likely to spend. But if you're lost here, a realtor can help you find a suitable property for you, too, especially if your wishlist is quite extensive, and you're struggling to find a property that is within your price range. Choose a reputable mover Also, as part of the home selection and moving process, Glovve points out that you'll want to choose a moving company that is as reliable as can be because the last thing you'll want to be doing is stressing over whether your belongings will be delivered in one piece. Again, it pays to do your research in this area by looking up reviews and testimonials online, as well as having those necessary conversations to ensure that you both are on the same page. A senior-friendly city could be a good option Of course, you probably want to move to a neighborhood that is going to be suitable for your lifestyle - in more ways than one. One of the ways you can check if a neighborhood really is for you is by looking it up online on SeniorScoreto get a better idea of what living there is actually like. You can also check to see if any old classmates live in the vicinity. Reconnect and find out how happy they are, what issues they face with transportation, healthcare, and other concerns you may have. Moving to a new home when you're older is going to take some adjusting, but it could end up being every bit of the adventure you'd hoped it would be if you play your cards right. Remember to keep accessibility in mind, know your financing options, check into a home warranty, and look for a senior-friendly location. Image via Pexels Team Stiles can assist you with your home buying and selling needs from start to finish. Connect with us today by calling (317)883-9461!

Categories

Recent Posts